The CYFIRMA Industry Report delivers original cybersecurity insights and telemetry-driven statistics of global industries, covering one sector each week for a quarter. This report focuses on the automotive industry, presenting key trends and statistics in an engaging infographic format.

Welcome to the CYFIRMA infographic industry report, where we delve into the external threat landscape of the automotive industry over the past three months. This report provides valuable insights and data-driven statistics, delivering a concise analysis of attack campaigns, phishing telemetry, and ransomware incidents targeting the automotive industry.

We aim to present an industry-specific overview in a convenient, engaging, and informative format. Leveraging our cutting-edge platform telemetry and the expertise of our analysts, we bring you actionable intelligence to stay ahead in the cybersecurity landscape.

CYFIRMA provides cyber threat intelligence and external threat landscape management platforms, DeCYFIR and DeTCT, which utilize artificial intelligence and machine learning to ingest and process relevant data, complemented by manual CTI research.

For the purpose of these reports, we leverage the following data from our platform. These are data processed by AI and ML automation based on both human research input and automated ingestions.

While this report contains statistics and graphs generated primarily by automation, it undergoes thorough review and enhancement for additional context by CYFIRMA CTI analysts to ensure the highest quality and provide valuable insights.

Automotive organizations featured in 4 out of the 15 observed campaigns, which is a presence in 26.6% of all campaigns.

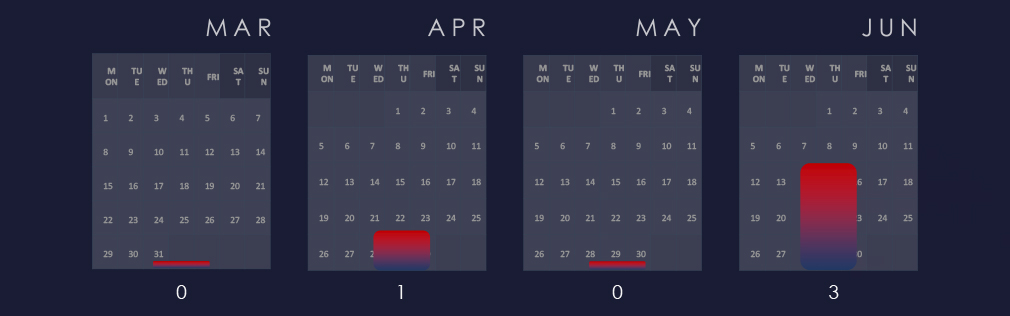

Following a period of generally low detections, the volume of observed campaigns increased in June. This uptick is correlated with global trends rather than being industry-specific.

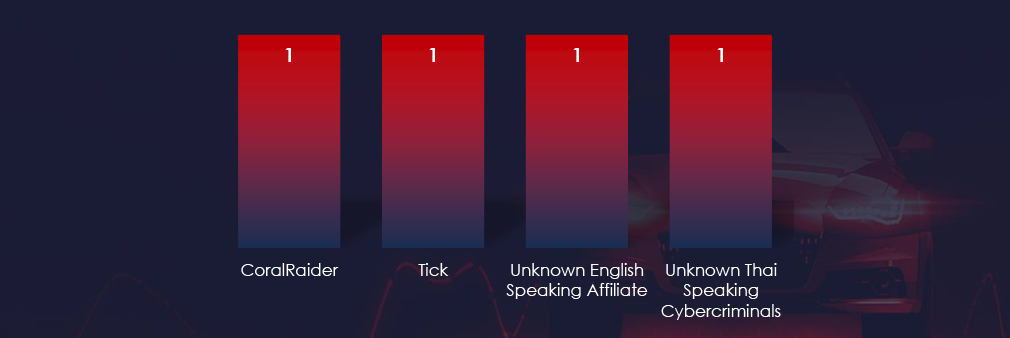

We observed a varied mix of TTPs and languages used on relevant forums. In addition to the well-known Chinese group TICK, we identified the Vietnamese group CoralRaider, an unknown Thai-speaking cybercriminal group, and an English-speaking group with an interest in targets in East and Southeast Asia.

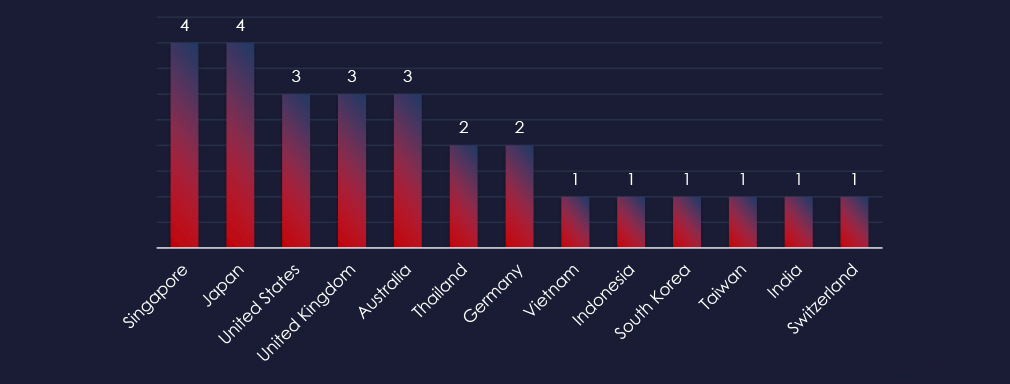

Recorded victims of observed attack campaigns span 13 different countries with high focus on East and Southeast Asia, which corresponds with what we identified about threat actors.

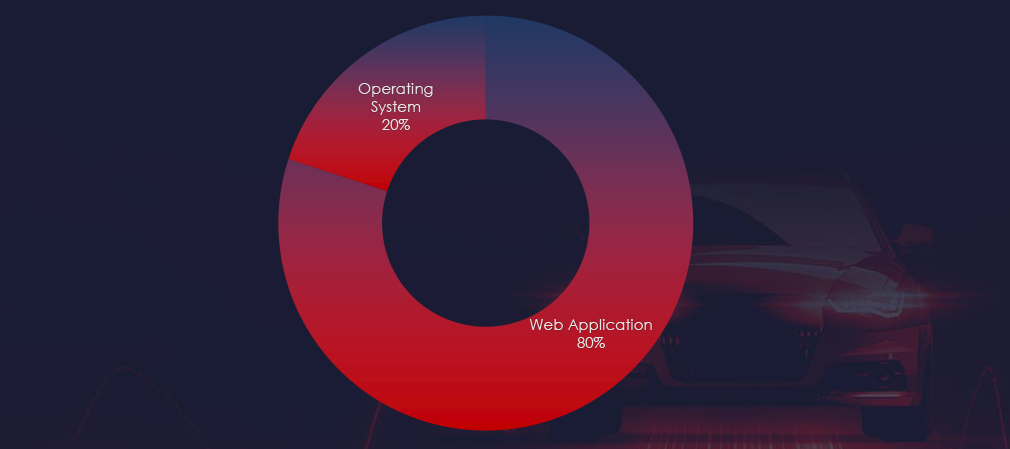

Web applications continue to be the most targeted technology across industries, with operating system exploitation tools also being observed.

Risk Level Indicator: Low

In the past 90 days, automotive organizations have not been significantly impacted by advanced persistent threat (APT) campaigns. Although 26.6% of observed APT campaigns were related to the automotive sector, all 4 out of the 15 campaigns targeted various suppliers of components, such as plastic moulds or semiconductors, that are not exclusive to the automotive industry.

Monthly Trends

After a lower detections period, the volume of observed campaigns increased in June. Observed uptick is therefore correlated with global trends rather than being industry-specific.

Key Threat Actors

A varied mix of TTPs and languages used by threat actors were detected on relevant forums. In addition to the well-known Chinese group TICK, we identified the Vietnamese group CoralRaider, an unknown Thai-speaking cybercriminal group, and an English-speaking group with an interest in targets in East and Southeast Asia.

Geographical Impact

The campaigns impacted a total of 13 countries with particular focus on East and Southeast Asia, corresponding to identified background of observed Threat Actors.

Targeted Technologies

Web applications and operating systems exploitation were used in the the observed campaigns as primary TTPs.

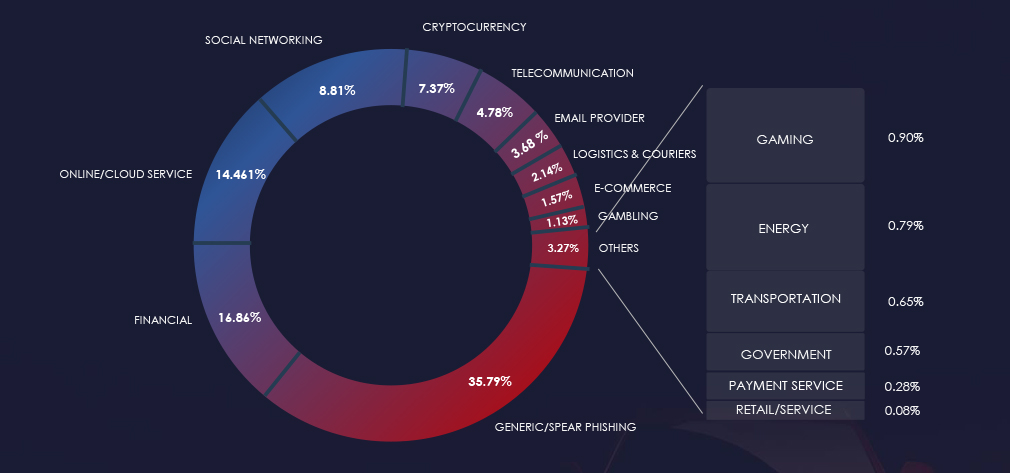

Over the past 3 months, CYFIRMA’s telemetry detected 91 phishing campaigns themed around automotive out of a total of 260,275.

The chart below illustrates the global distribution of observed themes. Automotive accounts only for 0.03% of all captured phishing attempts and therefore is not tracked as a category.

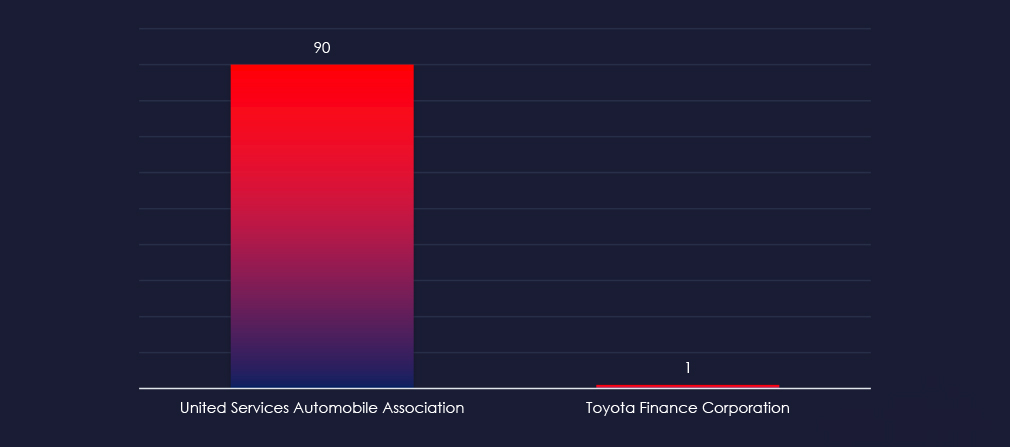

All automotive-related phishing is actually focused on automotive financing. Nearly all instances impersonate the United Services Automobile Association, with some samples also involving Toyota Finance Corporation.

The geographical sources of observed phishing campaigns show that most of automotive themed phishing comes from the US, which aligns with the observed impersonations of USAA.

Risk Level Indicator: Low

The automotive industry warrants low risk factor.

As established in previous automotive industry reports, it does not present an attractive lure for wider “spray and pray” types of phishing campaigns.

The data indicates that United Services Automobile Association and Toyota Finance Corporation are the only identified impersonated organizations related to automotive, though it aligns more closely with the financial industry.

ASN-origin data reveals that the United States are the leading source of phishing emails impersonating observed related themes.

The automotive sector is typically not a prime target for phishing campaigns, except for instances involving spear-phishing attacks by geopolitically motivated Advanced Persistent Threats (APTs) and ransomware affiliates. This is primarily because cybercrime is opportunistic, with sectors like finance and healthcare being much easier to monetize.

Consequently, phishing campaigns targeting the automotive industry tend to focus on related financial services, such as leasing or insurance.

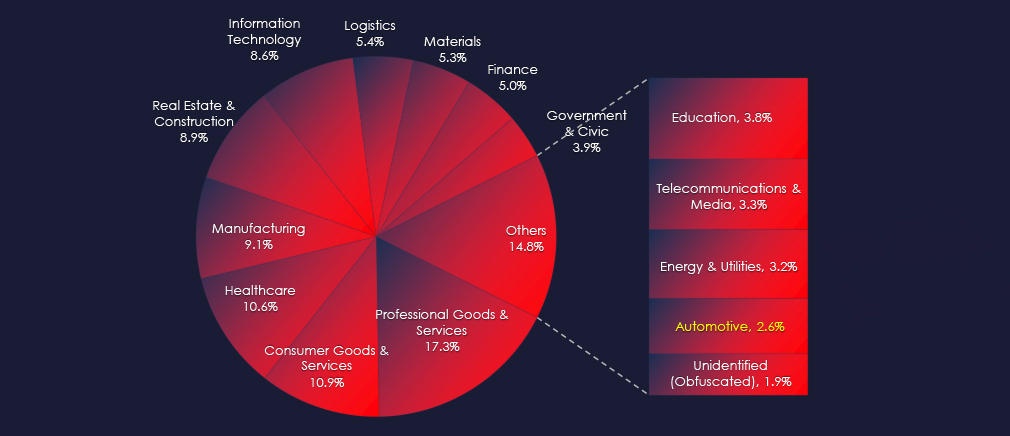

In the past 90 days, CYFIRMA has identified 32 verified ransomware victims in the automotive industry. This accounts for 2.6% of the overall total of 1,241 ransomware victims during the same period.

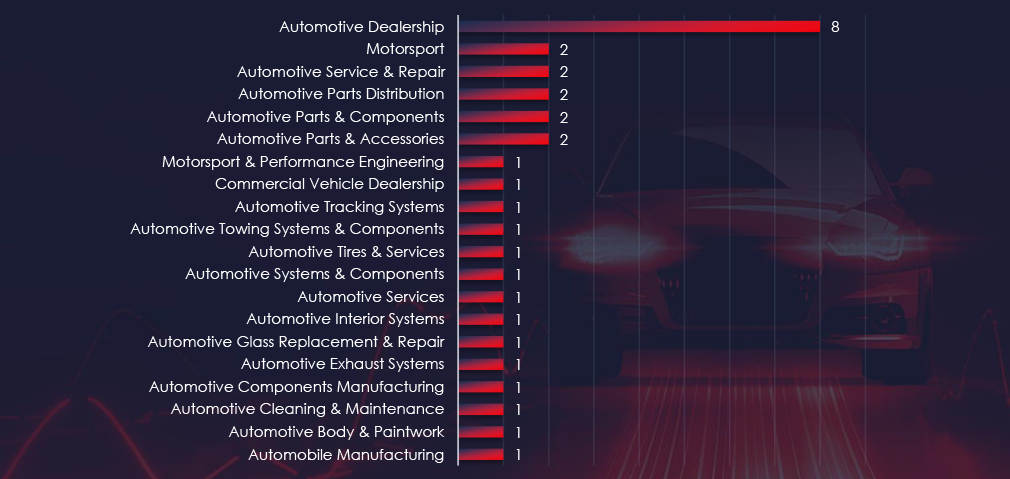

Automotive Dealerships are the most frequent victims of ransomware in automotive industry. However, they only account for 9 out of 32 victims.

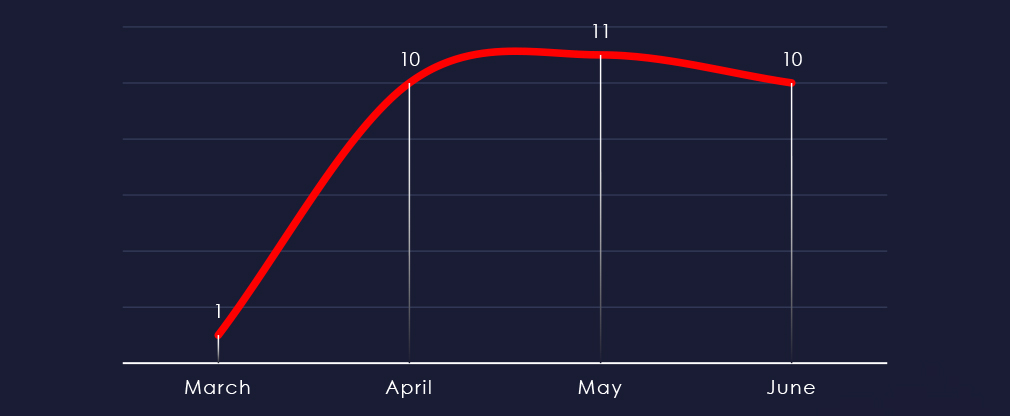

Considering just two days of March, we can see remarkably consistent numbers of victims during April, May and June.

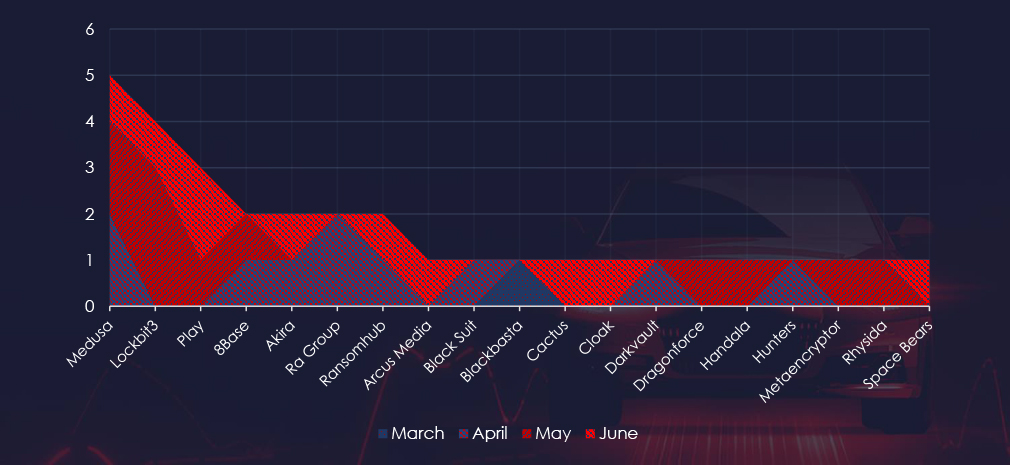

A breakdown of the monthly activity provides insights into which gangs were active each month. For example, LockBit3 came back in May, Ra groups was active in April and Cactus with Cloak in June.

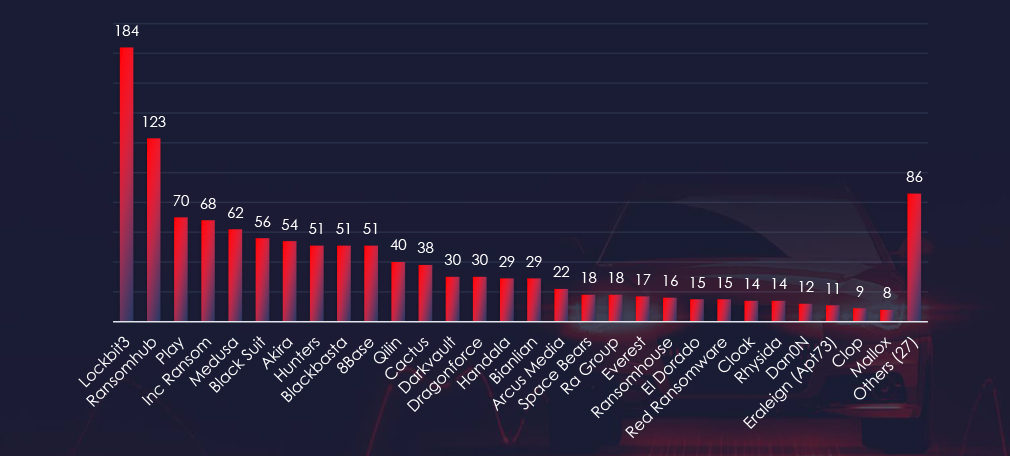

In total 19 out of 54 active groups recorded automotive organizations victims in the past 90 days. Notable is a high distribution of 19 per 32 victims.

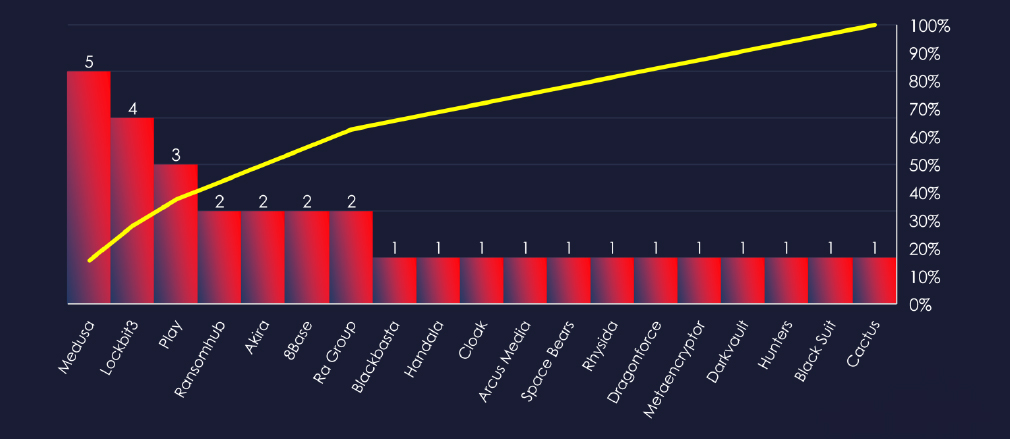

Comparing the automotive industry to all recorded victims, Medusa gang stands out with 5 out of 62 victims (8%) in this industry, implying focused interest.

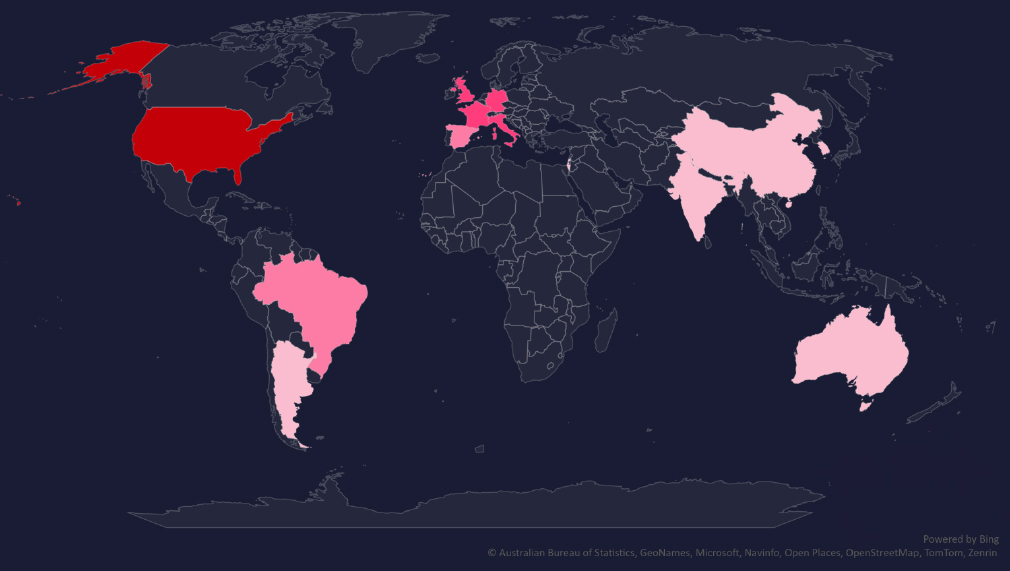

The geographic distribution heatmap underscores the widespread impact of ransomware, highlighting the countries where victims in this industry have been recorded.

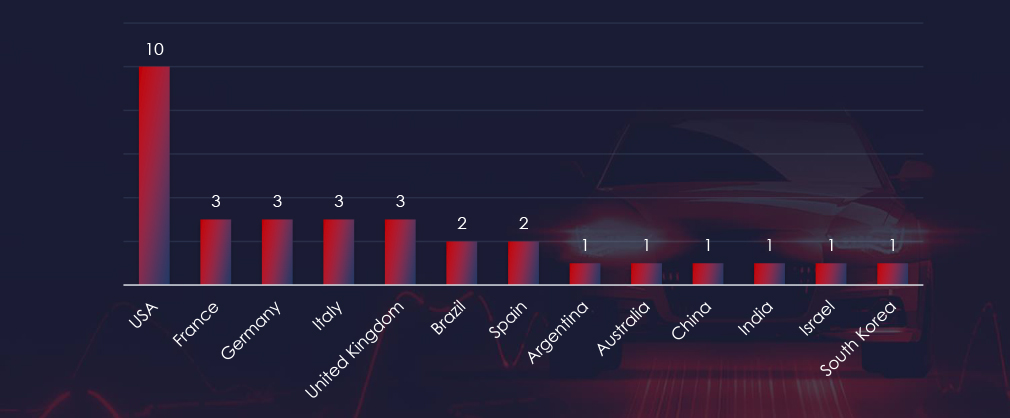

In total 13 countries recorded ransomware victims with the US alone accounting for 31% of all victims with identified geography.

Risk Level Indicator: High

The automotive industry is the least frequent victim of ransomware, staying in the 14th place. However, it is a very narrow scope. Encompassing 2.6% of all ransomware victims, it faces a significant ransomware risk.

Monthly Activity Trends

Ransomware activity in the automotive industry has shown remarkably consistent numbers of 10 to 11 victims each month.

Ra Groups was active in April, LockBit3 returned in May, Cactus and Cloak recorded victims in June and the Medusa gang was active across all months.

Ransomware Gangs

A total of 19 out of 54 active ransomware groups targeted the automotive industry in the past 90 days:

Medusa: 8% of their victims were from this industry (5 out of 62 victims), implying a possible focus on this industry

LockBit3: Due to its large affiliate base and sheer volume, it presents a high risk (4 out of 184 victims).

The distribution of attacks among many groups indicates that no single gang dominated the ransomware landscape in the automotive sector.

Geographic Distribution

The geographic distribution of ransomware victims in the automotive industry highlights the widespread nature of these attacks:

31% of all victims are located in the US, followed by traditional European automotive countries like Germany, Italy, France and the UK.

In total, 13 countries reported ransomware victims in this industry

For a comprehensive, up-to-date global ransomware tracking report, please refer to our new monthly “Tracking Ransomware” series here.

In the past 90 days, automotive organizations have faced low to high risk across monitored categories.

APT Campaigns: Although 26.6% of observed APT campaigns related to the automotive sector, they primarily targeted suppliers of components like plastic moulds and semiconductors, making the overall risk low. Activity increased in June, reflecting global trends rather than industry-specific threats. Key actors included TICK (China), CoralRaider (Vietnam), an unknown Thai-speaking group, and an English-speaking group targeting East and Southeast Asia. The campaigns mainly exploited web applications and operating systems, impacting 13 countries in these regions.

Phishing: The risk remains low for the automotive sector, which is not an attractive target for broad phishing campaigns. Notable impersonated organizations included the United Services Automobile Association and Toyota Finance Corporation, aligning more with the financial industry. The US was the leading source of phishing emails. Geopolitically motivated APTs and ransomware affiliates pose spear-phishing threats.

Ransomware: The automotive industry faces a high ransomware risk, despite being the least frequent victim at 14th place. Given its narrow scope, it is still encompassing 2.6% of all ransomware victims. Consistent monthly activity saw 10 to 11 victims each month. Active groups included Medusa, LockBit3, Cactus, and Cloak, with Medusa showing a potential focus on the sector. The geographic distribution of victims is widespread, with 31% in the US and others in key European automotive countries like Germany, Italy, France, and the UK, affecting 13 countries in total.